The Capitalisation of Net Income is the primary method of valuation and is performed by assessing a net achievable income (based on the childcare centre’s performance) and capitalising that into perpetuity at an appropriate capitalisation rate (yield). The capitalisation rate is derived by analysing recent childcare centre sales that are considered comparable.

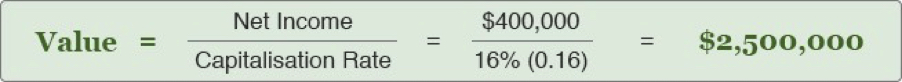

For example, if the Valuer adopts an achievable net income of $400,000 per annum and a capitalisation rate of 16%, the adopted value would be calculated by dividing the net income by the capitalisation rate.

Whilst some centres will be licensed for additional places to cater for Outside School Hours Care (OSHC), generally only the licensed long day care places are considered.

This method is generally performed as a check method to ensure the value derived from the Capitalisation of Net Income approach reflects a Rate per Licensed Childcare Place that is within the range of the sales evidence. If the number of licensed childcare places in this centre is 75, the above value of $2,500,000 would reflect $33,333 per licensed childcare place.

The appropriate rate per licensed childcare place will vary depending on the centre’s performance, location, quality of the improvements and a variety of other factors.

Freehold Investment properties (Lessor’s Interest) are valued in the same manner, however profit and loss statements and occupancy reports are generally not analysed as they affect the value of the leasehold interest (business), not necessarily the freehold component.

If a centre is performing poorly this will affect the value of the Freehold interest so far as the market rent is concerned and the ability of the lessor to re-lease the property if the lease expires.

The key factors in such a valuation will be the rent being received from the lessee (and whether it is at market), the remaining term of the lease and what outgoings are not recoverable.

Often land tax is not the responsibility of the lessee and therefore this must be deducted from the net rental received from the lessee to arrive at the net income that can be capitalised.

Generally, capitalisation rates for Freehold Investments are lower (firmer) due to the investment being passive and there being limited business risk to the lessor.

Leasehold properties (Lessee’s Interest) are valued in the same manner as the Freehold Going Concern interest however the valuation is only concerned with the value of the business component, not the value of the land and buildings.

The key factors of the valuation will be:

As a lease term is reduced, the value of the Leasehold interest will also diminish. For example, a Leasehold interest with 30 years remaining on the lease will be more attractive than another with only five years remaining.

Generally, capitalisation rates for Leasehold properties are higher (softer) due to the high level of risk associated with the investment.

For more specific information on competitive refinancing for your existing childcare business or funding options for a new opportunity please reach out.

Recommended Childcare Industry ProfessionalsIf you are looking to purchase a childcare centre, getting experienced professionals on your side is the first step – business brokers, solicitors, accountants, financial planners, tax advisors. I work with proven specialists in the childcare field daily and am happy to point you in the right direction. |

THE FINEPRINT: The information provided on this site is on the understanding that it is for illustrative and discussion purposes only. While all care and attention are taken in its preparation any party seeking to rely on its content or otherwise should make their own enquiries and research to ensure its relevance to your specific personal and business requirements and circumstances.

Green Finance Group Pty Ltd ACN 145 035 221 is authorised under LMG Broker Services Pty Ltd ACN 632 405 504 Australian Credit Licence 517192.

"While my extensive industry experience covers all areas of banking, loans and leasing – commercial, equipment and residential – my business finance specialties are the broader hospitality, accommodation and childcare industries."

Fortitude Valley, Brisbane

Australia's leading hospitality, accommodation and childcare finance specialist and winner of Australian Broker of the Year 2022.

Prior to establishing GFG in 2010, I occupied senior management roles in some of Australia's leading financial institutions including Commonwealth Bank of Australia, Suncorp, Bankwest and Westpac.